The price hike will affect both new and existing car owners who are renewing their insurance policy.

Price hike of Rs 222 (12 per cent) for cars displacing less than 1000cc.

Price hike of Rs 358 (12.5 per cent) for 1000-1500cc cars.

No change in third-party premium for cars displacing over 1500cc.

The Insurance Regulatory and Development Authority of India (IRDAI) has decided to increase the price of third-party car insurance premium (private vehicles) from 16 June 2019. The increase in third-party insurance will affect both new car buyers and existing owners who are renewing their insurance cover.

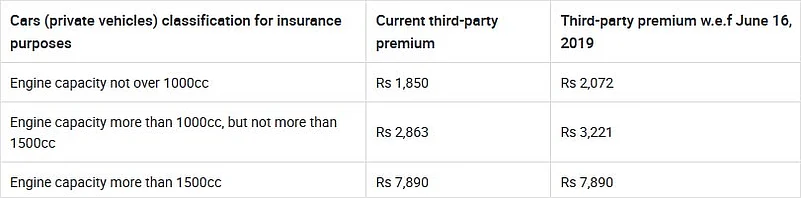

The third-party premium part of a car insurance is fixed and doesn’t change with changing IDV (insured declared value). As of now, the third-party premium is set at Rs 1,850 for cars with engine capacity up to 1000cc. This amount is set to go up to Rs 2,072, a hike of Rs 222 (12 per cent) from 16 June.

Advertisement

Similarly, third-party premium for cars with engine capacity between 1000cc and 1500cc will increase by Rs 358 from 16 June 2019. At present, the third-party premium for these cars is fixed at Rs 2,863 and going forward, this amount will go up to Rs 3,221, an increase of 12.5 per cent.

It must be noted that the third-party premium for cars with engine capacity higher than 1500cc is not going to change. At present, the fixed amount of third-party premium for these cars is Rs 7,890.

It is now mandatory to get a minimum three-year third-party insurance cover with every new car. So there would be a minimum increase of Rs 666 in third-party premium when buying a new car with engine capacity of up to 1000cc. Similarly, the increase in third-party insurance premium for cars with engine capacity between 1000cc and 1500cc will be Rs 1,074. All said and done, the increase in third-party premium is not high enough for us to suggest you to prepone either your new car purchase or insurance renewal.

Advertisement

Source: cardekho.com