Outlook Lens

Politicians visiting Madhya Pradesh are making big promises to the people, but for the Adivasis, it’s still about Jal, Jungle, Jameen

Advertisement

Latest

Advertisement

After the murder of a 23-year-old college student in Karnataka, the Congress government has dismissed the BJP's charge of the case being "love jihad".

Advertisement

The first phase of Lok Sabha Elections 2024 covering a total of 102 constituencies across 21 states and Union Territories (UTs) ended with a turnout of 60 per cent. The highest voter turnout was recorded in Tripura at 80.14 per cent followed by West Bengal at 77.57 percent, with Bihar witnessing the lowest turnout at 47.93 percent according to the final data released by the Election Commission of India at 7 PM.

The Iranian Embassy in Paris was cordoned off after a man entered the building with a bunch of explosives and threatened to blow himself up.

Magazine

Magazine Home

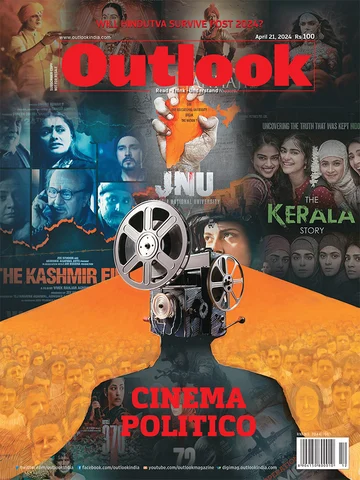

This issue of Outlook looks at the genre of nationalist and propaganda cinema in the Indian context, and also continues with the exploration of the ideology question when it comes to national parties

There have been concerted attempts to portray JNU in a certain way. The film JNU: Jahangir National University is just another product of the same propaganda machinery

A recent spate of Hindi films distorts facts and creates imaginary villains. Century-old propaganda cinema has always relied on this tactic

At a time when Bollywood is churning out propagandist narratives, south cinema, too, has stories to tell

Cinema’s real potency to harness the power of enchantment might want to militate against its use as a servile, conformist propaganda vehicle

Representation of Muslim characters in Indian cinema has been limited—they are either terrorists or glorified individuals who have no substance other than fixed ideas of patriotism

In south India, films have always been a vehicle to ride into politics

Previously portrayed as a peaceful paradise, post-1990s Kashmir in Bollywood has become politicised

While the trailer of 'The Kerala Story' claimed that 32,000 women from Kerala had undergone conversion and joined the IS, Nazeer Hussain’s offer was open-ended

Public opinion will never be devoid of ideology; but we shall destroy ourselves without philosophical courage

In the upcoming election, more than the Congress, the future of the Gandhi family is at stake

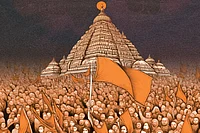

The idealogy of Hindutva faces a challenge in staying relevant

A seemingly harmless decision in 1979 ended up reshaping Indian politics. The biggest beneficiary was the BJP

Amar Singh Chamkila may be celebrated, but many of his songs are blatantly sexist

Hindutva pop stars are employing hyperbole and dog-whistling to ensure Modi gets a third term

Paul Murray’s The Bee Sting is a tender and extravagant sketch of apocalypse

Singing revolutionary songs was nothing new for us. However, going viral was definitely something new.

Previous Issue

Advertisement

Uttar Pradesh elections: Bhim Army and Aazad Samaj Party chief Chandrashekhar Azad, the renegade new face of Dalit assertion, is taking on the BSP, BJP and SP in Nagina this year in what appears to be a battle for the future of Dalit-Bahujan political leadership in West UP.

Lok Sabha Elections 2024: How Modi’s Guarantee Differs From Congress’ Nyay Patra

Delhi Capitals will meet Sunrisers Hyderabad in the group-stage fixture of the IPL 2024 in Delhi's Arun Jaitley Stadium on Saturday. Here are three key player battles from the match that are worth looking out for

Starring Jayam Ravi, 'Siren' is now available to stream on Disney+ Hotstar. Is this film worth watching or you can choose to skip it? Read the full review to find out.

‘Anyone But You’ has been in the news since a long time. The film is running in theatres for over 2 months now, but the makers have decided to push it out on OTT. Is it worth spending your time? Or can you simply skip it? Read the full movie review to find out.

Celebrities and dignitaries including Malala Yousafzai and Hillary Clinton dazzle at the star-studded 'Suffs' Broadway debut in NYC's Music Box Theatre.

Join the iconic 'Pulp Fiction' cast, including John Travolta, Uma Thurman, and Samuel L. Jackson, as they reunite for the film's 30th anniversary at the TCM Classic Film Festival 2024. See the stars relive cinematic history in Los Angeles.

From serene nature walks and cultural immersions to wellness retreats and spiritual journeys, Bhutan invites visitors of all ages to embrace the beauty of slow exploration and meaningful engagement

Lost In Time: Unveiling The Ancient Barabar Caves Near Bodh Gaya

![롤 토토 사이트 추천 [ TOP 3 ]](https://media.assettype.com/outlookindia/2024-04/29f881db-0a98-472e-9537-587d11a6742e/1.jpg)