Outlook Lens

The Election Commission (ECI) has taken impressive steps forward in launching creative campaigns asking people to fulfil their democratic duty while ensuring a safe and sound election season.

Advertisement

Latest

Advertisement

Air India spokesperson has reportedly said the airliner accords top priority to the safety of its passengers, crew and aircraft.

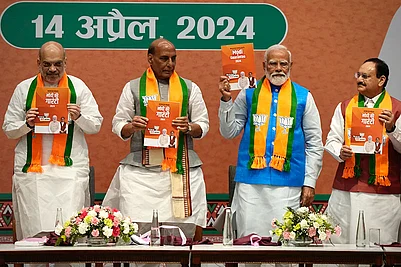

2024 Elections LIVE News: With less than a week left for the high-octane Lok Sabha polls, political parties across the nation are reaching the final rounds of their election campaigns. PM Narendra Modi held poll rallies in West Bengal today. As per the poll schedule announced by the Election Commission of India (ECI), polling will commence on April 19 while the last phase is set to take place on June 1. To stay updated with election-related developments, keep an eye on Outlook.

As tensions between Iran and Israel rise, the UN's nuclear watchdog has raised its concerns about Israel launching a retaliatory attack to target Iran's nuclear sites. Furthermore, Israeli President Isaac Herzog has stated that Iran's attack was a "declaration of war" against the Jewish State.

Magazine

Magazine Home

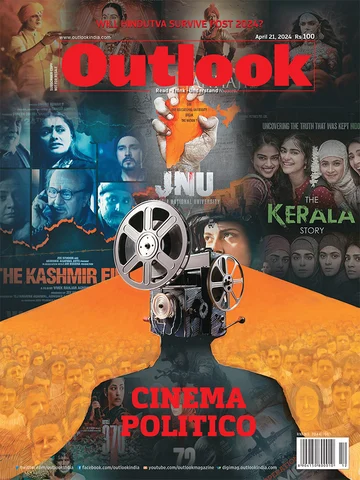

This issue of Outlook looks at the genre of nationalist and propaganda cinema in the Indian context, and also continues with the exploration of the ideology question when it comes to national parties

There have been concerted attempts to portray JNU in a certain way. The film JNU: Jahangir National University is just another product of the same propaganda machinery

A recent spate of Hindi films distorts facts and creates imaginary villains. Century-old propaganda cinema has always relied on this tactic

At a time when Bollywood is churning out propagandist narratives, south cinema, too, has stories to tell

Cinema’s real potency to harness the power of enchantment might want to militate against its use as a servile, conformist propaganda vehicle

Representation of Muslim characters in Indian cinema has been limited—they are either terrorists or glorified individuals who have no substance other than fixed ideas of patriotism

In south India, films have always been a vehicle to ride into politics

Previously portrayed as a peaceful paradise, post-1990s Kashmir in Bollywood has become politicised

While the trailer of 'The Kerala Story' claimed that 32,000 women from Kerala had undergone conversion and joined the IS, Nazeer Hussain’s offer was open-ended

Public opinion will never be devoid of ideology; but we shall destroy ourselves without philosophical courage

In the upcoming election, more than the Congress, the future of the Gandhi family is at stake

The idealogy of Hindutva faces a challenge in staying relevant

A seemingly harmless decision in 1979 ended up reshaping Indian politics. The biggest beneficiary was the BJP

Amar Singh Chamkila may be celebrated, but many of his songs are blatantly sexist

Hindutva pop stars are employing hyperbole and dog-whistling to ensure Modi gets a third term

Paul Murray’s The Bee Sting is a tender and extravagant sketch of apocalypse

Singing revolutionary songs was nothing new for us. However, going viral was definitely something new.

Previous Issue

Advertisement

Iran’s actions have helped Netanyahu’s government to turn the spotlight from its actions in Gaza that had come in for criticism even from loyal friends like US President Joe Biden to Iran.

Zomato Launches 'Large Order Fleet', Serving Groups Of Up To 50 People

The top two rankers of the Indian Premier League (IPL) 2024 - Kolkata Knight Riders and Rajasthan Royals meet in Kolkata's Eden Gardens. Both teams have lost only a single match so far and it will be interesting to see which team comes on top. Phil Salt's most recent knock against Lucknow Super Giants makes their star-studded team look more destructive. On the other hand, Rajasthan Royals' openers need to perform better against KKR. A high-scoring game is on the cards. Some high-profile players are going to play in today's contest. Follow the live cricket scores and updates of the KKR Vs RR match of the IPL 2024, here

Advertisement

‘Vicky Vidya Ka Woh Wala Video’ marks Rajkummar Rao and Triptii Dimri's first film together.

Anushka Sharma and Virat Kohli welcomed their second child in February this year, and named him Akaay.

Palak Sindhwani, who plays the role of Sonu Bhide in 'Taarak Mehta Ka Ooltah Chashmah', has become the talk of the town. Read here to know why.

Late actor Vijayakanth will be seen in a cameo role in Vijay starrer 'The Greatest Of All Time' (GOAT). His wife confirmed the news.

While a Leh-Ladakh tour offers unparalleled beauty and adventure, elderly travellers must prioritise their health, safety, and comfort by meticulously planning and preparing for the challenges posed by high-altitude travel

OT Itinerary: 2-Days In Chikkamagaluru, The Land Of Coffee

![프리미어리그 배팅 사이트 [ TOP 3 ]](https://media.assettype.com/outlookindia/2024-04/b4f2e6a0-9a88-481b-85c5-080114180646/1.jpg)