Outlook Lens

What has been Modi government's approach in dealing with this long-standing problem?

Advertisement

The Kochi city police on Tuesday filed a case against the two women under IPC section 153 (wantonly giving provocation with the intent to cause riot, whether or not riot is committed).

Advertisement

Titled 'Didir Shopoth', TMC released its manifesto in five languages including Nepali and Oi Chiki.

Tens of thousands of soldiers and citizens have died in Ukraine's two-year war, which began on February 24, 2022, with the Russian invasion.

Advertisement

Magazine

Magazine Home

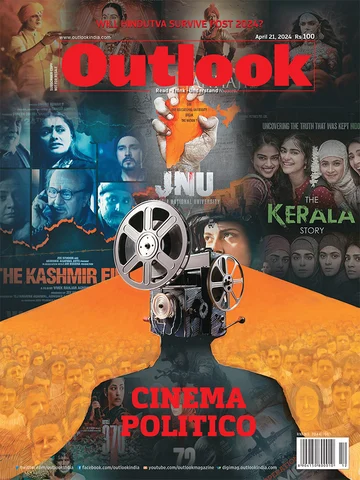

This issue of Outlook looks at the genre of nationalist and propaganda cinema in the Indian context, and also continues with the exploration of the ideology question when it comes to national parties

There have been concerted attempts to portray JNU in a certain way. The film JNU: Jahangir National University is just another product of the same propaganda machinery

A recent spate of Hindi films distorts facts and creates imaginary villains. Century-old propaganda cinema has always relied on this tactic

At a time when Bollywood is churning out propagandist narratives, south cinema, too, has stories to tell

Cinema’s real potency to harness the power of enchantment might want to militate against its use as a servile, conformist propaganda vehicle

Representation of Muslim characters in Indian cinema has been limited—they are either terrorists or glorified individuals who have no substance other than fixed ideas of patriotism

In south India, films have always been a vehicle to ride into politics

Previously portrayed as a peaceful paradise, post-1990s Kashmir in Bollywood has become politicised

While the trailer of 'The Kerala Story' claimed that 32,000 women from Kerala had undergone conversion and joined the IS, Nazeer Hussain’s offer was open-ended

Public opinion will never be devoid of ideology; but we shall destroy ourselves without philosophical courage

In the upcoming election, more than the Congress, the future of the Gandhi family is at stake

The idealogy of Hindutva faces a challenge in staying relevant

A seemingly harmless decision in 1979 ended up reshaping Indian politics. The biggest beneficiary was the BJP

Amar Singh Chamkila may be celebrated, but many of his songs are blatantly sexist

Hindutva pop stars are employing hyperbole and dog-whistling to ensure Modi gets a third term

Paul Murray’s The Bee Sting is a tender and extravagant sketch of apocalypse

Singing revolutionary songs was nothing new for us. However, going viral was definitely something new.

Previous Issue

Advertisement

What used to be a peaceful religious celebration has taken a sharp political turn with ominous communal contours

Lok Sabha Polls 2024: How Much Does It Cost To Hold Elections In World’s Largest Democracy

The two teams are at the bottom half in the IPL 2024 points table, here are the key battles that would decide the course of the game

A day dedicated to creating awareness about the significant sites around the world and the importance of keeping them safe, 'World Heritage Day', is celebrated on April 18, every year.

Written and directed by Dhruv Solanki, 'It's All In Your Head' is finally available to stream on OTT. Is the film worth watching? Is it relatable? Read on to find out.

AP Dhillon paid tribute to late singer Sidhu Moosewala at Coachella. The singer also shared a series of images with a caption that explains why he broke his guitar on stage.

Anjum Batra played Kesar Singh Tikka in Imtiaz Ali's directorial 'Amar Singh Chamkila'. He shared his working experience with Diljit Dosanjh and Imtiaz.

popular

Advertisement

Uttarakhand offers a plethora of relaxing getaways tailored to the preferences of elderly travellers

OT Itinerary: A Week Exploring The Best Of Kenya

![라이트닝 바카라 사이트 [ TOP 3 ]](https://media.assettype.com/outlookindia/2024-04/4beed037-a2b6-4824-b41b-ece0c6f8edaf/image1.png)