Outlook Lens

What used to be a peaceful religious celebration has taken a sharp political turn with ominous communal contours

Advertisement

Latest

Advertisement

Ahead of Ram Navami celebrations, West Bengal has been placed on high alert to avert any communal tensions across the state. Over in Ayodhya, the newly-built Ram Mandir marks its first Ram Navami with grand celebrations.

Advertisement

In Uttar Pradesh, Rahul Gandhi has "predicted" that the ruling party BJP will not win more than 150 seats. With just two days to go for the Lok Sabha Elections, the Congress leader also discussed the Amethi question.

A former employee of the Office of the High Commissioner for Human Rights (OHCHR) has claimed that the United Nations has been covering up "dangerous favours" it carried out for China. The evidence submitted by Emma Reilly ranges from illegal detentions to a COVID-19 cover up.

Magazine

Magazine Home

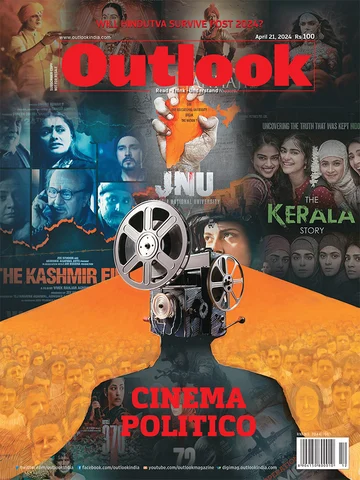

This issue of Outlook looks at the genre of nationalist and propaganda cinema in the Indian context, and also continues with the exploration of the ideology question when it comes to national parties

There have been concerted attempts to portray JNU in a certain way. The film JNU: Jahangir National University is just another product of the same propaganda machinery

A recent spate of Hindi films distorts facts and creates imaginary villains. Century-old propaganda cinema has always relied on this tactic

At a time when Bollywood is churning out propagandist narratives, south cinema, too, has stories to tell

Cinema’s real potency to harness the power of enchantment might want to militate against its use as a servile, conformist propaganda vehicle

Representation of Muslim characters in Indian cinema has been limited—they are either terrorists or glorified individuals who have no substance other than fixed ideas of patriotism

In south India, films have always been a vehicle to ride into politics

Previously portrayed as a peaceful paradise, post-1990s Kashmir in Bollywood has become politicised

While the trailer of 'The Kerala Story' claimed that 32,000 women from Kerala had undergone conversion and joined the IS, Nazeer Hussain’s offer was open-ended

Public opinion will never be devoid of ideology; but we shall destroy ourselves without philosophical courage

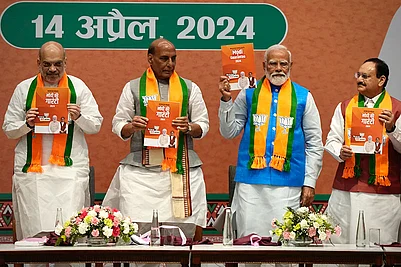

In the upcoming election, more than the Congress, the future of the Gandhi family is at stake

The idealogy of Hindutva faces a challenge in staying relevant

A seemingly harmless decision in 1979 ended up reshaping Indian politics. The biggest beneficiary was the BJP

Amar Singh Chamkila may be celebrated, but many of his songs are blatantly sexist

Hindutva pop stars are employing hyperbole and dog-whistling to ensure Modi gets a third term

Paul Murray’s The Bee Sting is a tender and extravagant sketch of apocalypse

Singing revolutionary songs was nothing new for us. However, going viral was definitely something new.

Previous Issue

Advertisement

Does the voter’s right to know come with limitations? Recent political developments and legal developments might have the answer.

Lok Sabha Polls 2024: How Much Does It Cost To Hold Elections In World’s Largest Democracy

The battle between the top two teams in the points table lived up to its billing, as match 31 of Indian Premier League 2024 was a record run-fest. Relive the Kolkata Knight Riders vs Rajasthan Royals game through our highlights

Maharashtra CM Eknath Shinde vowed to “finish Lawrence Bishnoi” after the firing incident outside Salman Khan’s Bandra residence.

Recently, Maharashtra CM Eknath Shinde paid a visit to Salman Khan’s residence, and the actor has been advised to resume work.

The second episode of Arhaan Khan's podcast will feature Malaika and Arhaan where the mother-son duo will be asking each other some steamy questions.

Nora Fatehi is under fire for her statement alleging that feminism has negatively impacted society.

Senior citizens have immensely benefitted from voice technology, from gadgetsfor companionship and connection to providing information and health assistance.

OT Itinerary: A Week Exploring The Best Of Kenya

![프리미어리그 배팅 사이트 [ TOP 3 ]](https://media.assettype.com/outlookindia/2024-04/b4f2e6a0-9a88-481b-85c5-080114180646/1.jpg)